Informa Reports Half-Year Revenue Surge and Accelerated Growth Through More Acquisitions and Investments

Informa PLC announced that its revenue and profit in the first half of 2023 shot up following a strong return to live events, in addition to plans for continued growth through an “exclusivity to acquire” HIMSS Global Health Exhibition/Conference and an investment in Talahuf, its Saudi Arabia trade show business.

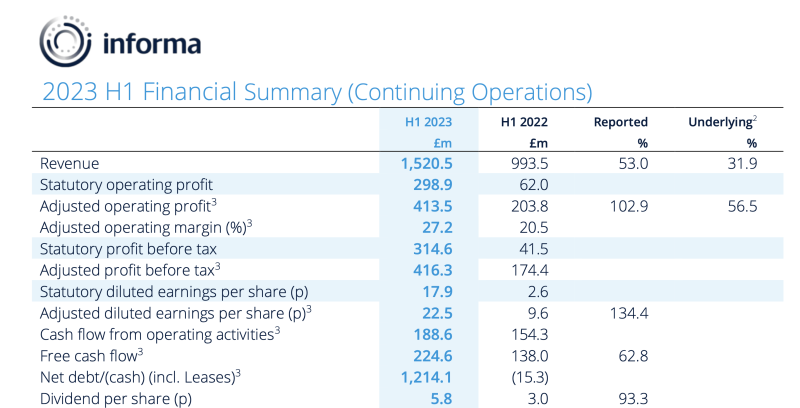

In its half-year that ended June 30, the London-based public company (which owns TSNN) reported that revenue increased 53% to GBP1.52 billion, up from GBP993.5 million in H1 2022. Pretax profit surged to GBP314.6 million, up from GPB41.5 million year over year.

During an earnings call today, Informa Group Chief Executive Lord Stephen A. Carter said the company saw a strong return to live and on-demand events in 2023, including in China, which has boosted profit.

“One thing you will notice in my presentation is the use of the C word — this isn’t a presentation about pre-COVID, in COVID or post-COVID,” Carter said. “This is the first time in a long time that we can have a conversation with our shareholders and the market about the fundamental strength of the commercial proposition that is the Informa company.”

Watch a recording of today’s Informa earnings presentation here.

Informa reported the company’s trade shows delivered strong performances in all major regions of the world, including North America, the Middle East, ASEAN, Europe and China, where Informa has seen rapid progress since COVID restrictions started to be removed earlier this year.

“Strong demand to access specialist B2B markets, launch new products and build sales pipelines means we also now expect revenues in China this year to be at similar levels to 2019,” Lord Carter said.

The company reported “particular strength through the first half in healthcare (Arab Health and Medlab Middle East), infrastructure and real estate (World of Concrete and The International Surface Event), health and nutrition (Natural Products Expo West and Vitafoods Europe) and beauty (China Beauty Expo).

Exclusivity to Acquire HIMSS

Exclusivity to Acquire HIMSS

Following two major acquisitions in H1 2023, Informa announced exclusivity to acquire the HIMSS Global Health Exhibition/Conference, the leading international trade show for healthcare technology and information management systems.

In 2023, HIMSS attracted more than 35,000 healthcare professionals from more than 90 countries, including physicians, nurses, analysts, government officials, investors and technology partners. The B2B trade show, held April 17-21 at Chicago’s McCormick, drew more than 1,200 exhibitors and featured more than 200 specialist education sessions. The post-show release can be found here.

In 2024, HIMSS, a TSNN top 30 U.S. trade show, will next take place March 11-15 at the Orange County Convention Center in Orlando.

Earlier this year, Informa acquired Tarsus for $940 million and Winsight for $380 million — a combined post-synergy multiple sub-9x enterprise value to earnings before interest, taxes, depreciation and amortization ratio (EV/EBITDA), according to the release. The sub-9x EV/EBITDA multiple is a measure of how much Informa paid for the business compared to a measure of how much profit that business generates.

The HIMSS acquisition would also have a combined post-synergy multiple sub-9x EV/EBITDA, according to the release, but the value of the deal was not disclosed.

Saudi Arabia’s Events Investment Fund Acquires a Stake in Tahaluf

Events Investment Fund (EIF), a part of National Development Fund, has acquired a stake in Tahaluf, the Saudi Arabian large-scale live events company created through a strategic joint venture between the Saudi Federation for Cybersecurity, Programming and Drones (SAFCSP) and Informa, according to a release. Terms of the deal that was signed yesterday were not disclosed.

The joint venture supports Saudi Arabia’s Vision 2030 to diversify the economy and increase its share in the non-oil GDP by bringing global expertise and foreign direct investment into the country and creating economic and environmentally sustainable public/private partnerships. The development of the meetings, incentives, conferences and exhibitions (MICE) ecosystem will support the contribution of the tourism sector to annual GDP, from its current rate of 3% to more than 10% by 2030.

“EIF is a multi-billion-dollar investment fund that intends to build 35 world-class venues and grow the MICE industry in Saudi Arabia,” Tahaluf CEO Mike Champion told TSNN. “Tahaluf plays a key role in attracting international audiences to these new, unique venue spaces, and by combining with the expertise from Sela, a company that has a proven track record for creating spectacular event experiences, we have the power to accelerate the growth of B2B and B2C event experiences in the Kingdom. We look forward to collaborating to launch new Saudi-born events and to bring iconic Informa brands to the Kingdom together.”

Following the launches of tech events including LEAP, Black Hat Middle East and Africa and DeepFest in the Kingdom, Tahaluf plans to launch further diverse original concept events, including the Saudi Maritime Congress, Global Health Exhibition and Inflavour, a trade show for the food industry. Tahaluf will also bring iconic Informa brands to Saudi Arabia, including CityScape, CPHI and Cosmoprof, serving the global real estate, pharmaceutical and beauty industries respectively.

“Tahaluf is a dynamic and ambitious initiative, and we are proud that Informa’s expertise is part of delivering world-class, sustainable events in Saudi Arabia,” Lord Carter said. “The incredible success of events such as LEAP have demonstrated the power of the Tahaluf collaboration, and this increased investment will accelerate its impact across sectors.”

SELA, the Saudi owned event production company, intends to join the joint venture in the near future.

Looking Ahead

Looking Ahead

“We are focused on building a better, broader and more scalable business, which is reflected in a very strong first half performance, putting us on track to meet or beat our guidance for 2023, with further momentum visible into 2024 and 2025,” Lord Carter said. “As the leading and largest owner/operator of B2B events, specialist data and digital services internationally, we see continuing strong demand from B2B customers, giving us confidence in further growth.”

Strong H1 trading and forward bookings puts Informa on track for the top end of guidance for both revenue (from £2.95bn to £3.05bn) and adjusted operating profit (from £750m to £790m), implying 30%-plus growth in revenue and 50%-plus growth in adjusted operating profit.

Main photo: Lord Stephen A. Carter, group chief executive, Informa

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on Twitter, Facebook and LinkedIn!

Add new comment