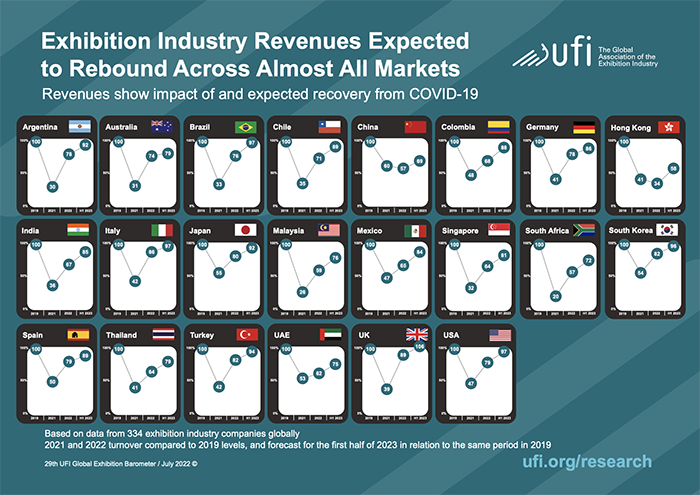

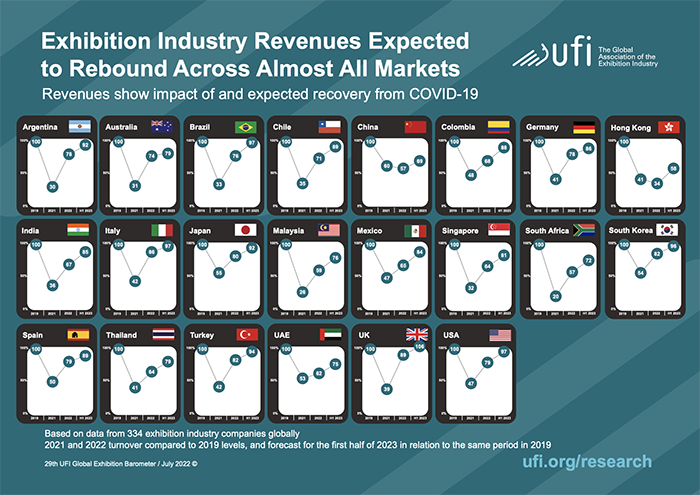

In July, UFI, the Global Association of the Exhibition Industry, released the latest edition of its flagship Global Exhibition Barometer research, which takes the pulse of the industry. The results highlight the quickening pace of the industry’s recovery in 2022, after the continuing impact of COVID-19 throughout 2021. The sector is bouncing back quickly, and revenues for H1 2023 are expected to reach 87% of comparable 2019 levels (noting that 2019 has been the industry’s record year to date).

What does the data mean, and how should exhibition organizers and companies use the research?

“It’s incredibly valuable to have this type of data to help shape and facilitate discussions internally about next year’s budgets to navigate a period of global uncertainty,” said Marty Glynn, CEO of MAD Event Management, which recently formed a strategic partnership with UFI to boost and develop the member services to its North American members. “Anyone who has global constituents can use the Barometer as basis for discussions with executive, sales/marketing and finance teams, especially associations.”

In addition to a global perspective, the UFI Barometer provides a deeper dive into the data for North America. Following are a few key takeaways.

The good news:

Revenue rebound. In the U.S., 2022 exhibition industry revenues are expected to reach 79% of what they were pre-COVID in 2019—the industry’s record year to date.

Looking ahead: In H1 2023, U.S. exhibition companies are projecting industry revenues will reach 97% of comparable 2019 levels. The U.S. exhibition industry is bouncing back faster than the global industry overall, which is expected to reach 73% of exhibition industry revenues in 2022 and 87% in H1 2023.

Public exhibition companies with significant holdings in the U.S. confirm UFI’s findings:

- On Aug. 4, Informa PLC reported H1 2022 results: 220-plus live events attracting 28,000-plus exhibitors, 1.1 million-plus attendees and £450 million in revenue, representing more than 80% of equivalent revenue in 2019.

- On July 28, RELX, parent company of RX Global, reported its full-year outlook for exhibitions: “We expect a year of strong underlying revenue growth, driven by reopening of exhibition venues across most geographies. The operating result will continue to benefit from the structurally lower cost base.” In 2021, exhibitions represented 7% of 2021 RELX revenue. In 2022, exhibitions represent 9% of RELX revenue YTD.

Triple-digit growth YOY. From 2021 to 2022, U.S. exhibition industry revenues are expected to increase 169% year-over-year. But it’s important to remember that U.S. exhibition industry revenues were significantly impacted in 2021 by travel restrictions and venue shutdowns due to the pandemic.

The biggest challenges:

Operating profits still below pre-pandemic highs. In 2022, more than half (54%) of North American exhibition organizations are reporting revenues will be reduced by 11% to 50%, compared to 2019.

- For example, in Q1 2022, revenue for Emerald events was down $36.6 million, or 37.1%, when compared to their last in-person editions. Keep in mind: A number of exhibition destinations, like New York, Los Angeles and Chicago, didn’t reopen fully for events until H2 2021.

- In H1 2022, 100% of exhibition organizations report their cities are already open to local and national events, according to the UFI Global Barometer. In its most recent financial statement, Emerald reported it continues to plan for a full slate of events in the U.S. in 2022.

Recruitment and staffing. What’s the most important business issue facing the industry in North America in 2022? The No. 1 issue is internal management challenges, as cited by 19% of North American exhibition organizations. After furloughs and layoffs due to shutdowns and limited activities for more than two years, 70% of North American exhibition organizations are recruiting additional staff following the restart of activities after the COVID-19 pandemic, with 59% of those citing it proves difficult to find the right people.

- Staffing is a challenge across most industries in the U.S.: Job growth accelerated at a much faster pace than expected in June, indicating that the main pillar of the U.S. economy remains strong despite pockets of weakness, according to data in June from the Bureau of Labor Statistics. The unemployment rate was 3.6%, unchanged from May and in line with estimates. Average hourly earnings increased 0.3% for the month of June and were up 5.1% from a year ago.

What has been your company’s experience? Please share your best practices with the industry in the comments.

In line with UFI’s objective to provide vital data and best practices to the entire exhibition industry, the full results can be downloaded at www.ufi.org/research. The next UFI Global Exhibition Barometer survey will be conducted in December 2022.

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on Twitter, Facebook, LinkedIn and Instagram!

Add new comment