Double-Digit Revenue Growth Projected for Global Trade Show Industry in 2024

The global exhibition industry is on track to achieve record revenues this year, according to UFI, the Global Association of the Exhibition Industry’s latest Global Exhibition Barometer flagship industry report.

Released on August 8, the 33rd edition of UFI’s bi-annual report, designed to take the pulse of the worldwide exhibitions industry, was concluded in July 2024 and includes data from 453 companies in 68 countries and regions, as well as dedicated outlooks and analysis for 19 focus countries and regions.

The Barometer’s results confirm UFI’s early data from its January report that showed 2024 to be a record year for global industry revenues, according to Kai Hattendorf, UFI managing director and CEO.

“This edition shows how this growth translates into new jobs in our sector as well as in expansion plans from the majority of businesses—aiming both at new business activities as well as new geographies,” Hattendorf said. “Against a complex global backdrop, the global exhibition industry is bullish about its short and mid-term prospects. The barometer also shows how 19 key exhibition markets and regions match up both against their respective regions and against the global averages.”

Following a deeper dive into the data, here are six takeaways from the report:

2024 revenues are expected to grow by 17% on average year on year

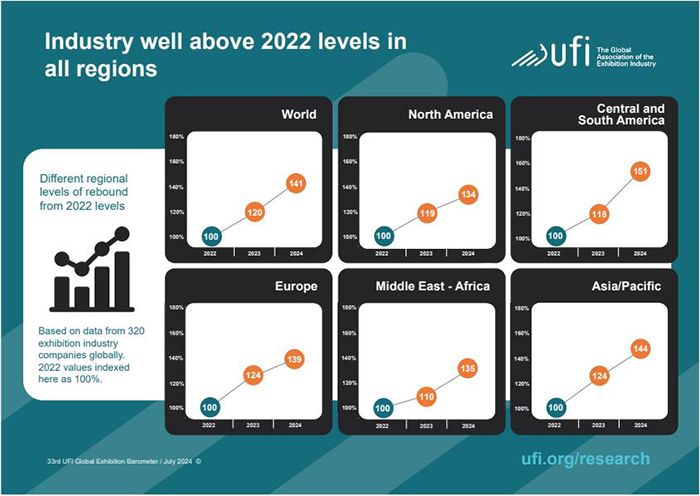

Globally, the exhibition industry is moving beyond its post-pandemic recovery, which was achieved at the end of 2023. According to the report, revenues increased by 20% on average in 2023, and this trend is expected to continue, with revenues expected to grow again by 17% on average year over year, varying from country to country, in 2024.

Operating levels and profits are picking up steam

Operating levels and profits are picking up steam

Globally, operation levels in the first half of 2024 picked up for half of the companies (4 out of 10 in Asia-Pacific, Central & South America, and the Middle East & Africa; and 6 out of 10 in Europe and North America) while one in three qualified these levels as “normal.”

This trend is anticipated to continue in the coming year with, on average, a percentage of companies reporting an increased activity ranging from 59% in North America to 50% in Asia-Pacific, 49% in the Middle East and Africa, and 48% in Central & South America and Europe, respectively. Meanwhile, 54% of respondents expect increased industry operations in the second half of 2024, with 34% expecting normal operations, and 10% expecting reduced.

As far as 2024 operating profits, 47% expect an increase of more than 10% compared to 2023, and 39% expect stable levels.

Looking ahead to the first half of 2025, 46% of companies predict an increase in industry operations, 35% expect normal levels, and 6% expect reduced,

Large portion of companies plan to increase staff numbers in the coming months

Workforce development is a key issue for global exhibition companies over the next six months, with 48% saying they plan to increase their workforce. Another 48% say they plan to keep their current staff numbers stable, and only 4% say they are looking to reduce staff.

State of the economy in home market remains the most pressing business issue

The most important issues on the minds of global exhibition companies are the state of the economy in home market (22% of answers globally) and global economic developments (15%), holding steady with last year’s results (22% and 17%, respectively). These are followed by geopolitical challenges (14%), competition from within the exhibition industry (14%), internal management challenges (11%), sustainability/climate (9%), and impact of digitalization (6%).

The most important issues on the minds of global exhibition companies are the state of the economy in home market (22% of answers globally) and global economic developments (15%), holding steady with last year’s results (22% and 17%, respectively). These are followed by geopolitical challenges (14%), competition from within the exhibition industry (14%), internal management challenges (11%), sustainability/climate (9%), and impact of digitalization (6%).

Majority of exhibition companies plan to expand their scope of activities, some into new countries and regions

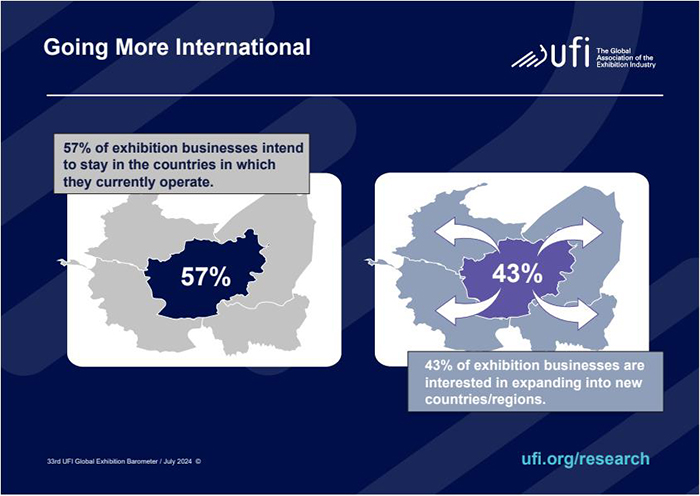

When it comes to current strategic priorities, 77% of companies across all regions say they are planning to develop new activities, either in the traditional range of exhibition industry activities (venue/organizer/services), outside of current product portfolios, or both. The percentage of companies intending to do this varies by region, with 84% in the Middle East and Africa, 83% in Europe, 75% in Central and South America, 74% in North America, and 69% in Asia-Pacific.

As far as geographic expansion, 43% of companies express intentions to expand their operations into new countries and regions while 57% intend to stay in the countries in which they currently operate.

Strong generative AI adaption is continuing across the industry

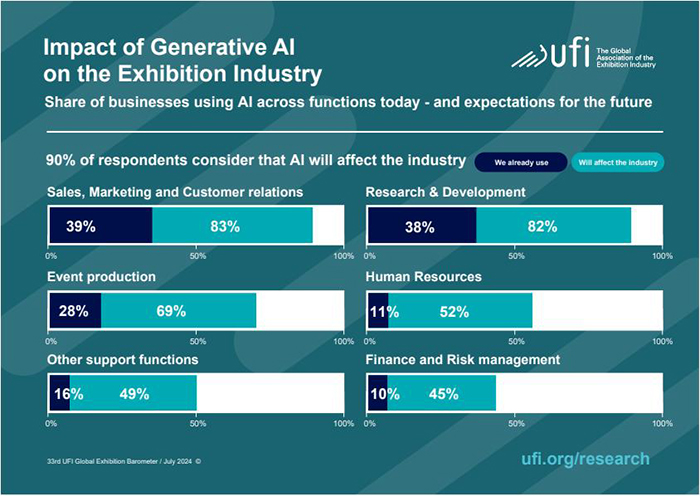

When asked how they believed generative AI applications, such as ChatGPT, will impact the exhibitions industry, 90% of respondents said it will affect the industry, with a growing share of businesses reporting they are actively using this new technology.

When asked how they believed generative AI applications, such as ChatGPT, will impact the exhibitions industry, 90% of respondents said it will affect the industry, with a growing share of businesses reporting they are actively using this new technology.

Areas anticipated to be most affected by AI development are the same in all regions: sales, marketing and customer relations (83% globally), research and development (82%), and event production (69%)—areas where generative AI applications are already mostly used, and in all regions.

The next UFI Global Exhibition Barometer survey will be conducted in December 2024. Download the full 2024 results, as well as other UFI reports here.

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on LinkedIn!

Add new comment