New Research About Booth Pricing Trends Amid Inflation Post-COVID

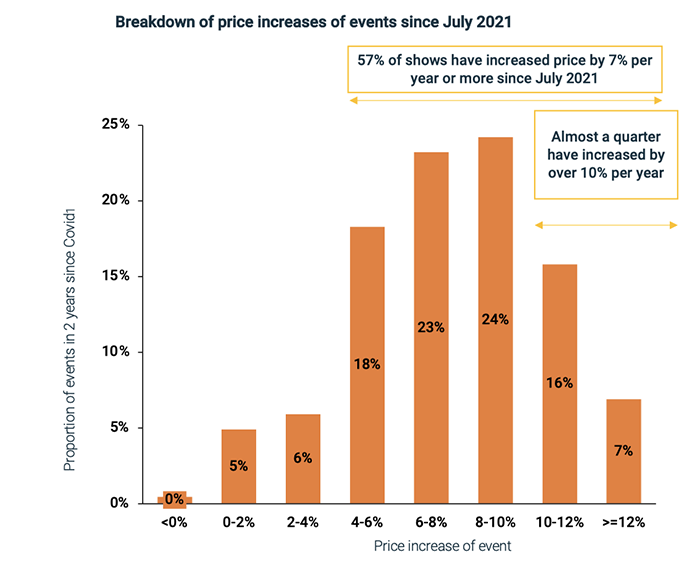

Post-COVID, the majority (57%) of trade shows have been able to achieve 7% annual price increases for booth space, significantly greater than pre-pandemic price increases, according to new research by SmartXpo and Profisy. Further, the research reveals that strong exhibition event portfolios were able to match prices with inflation post-pandemic.

In the U.S., the annual inflation rate was 7% in 2021 and 6.5% in 2022, according to the U.S. Labor Department. The good news: It continues to trend down. The annual inflation rate for the U.S. was 3.7% for the 12 months that ended in August, according to U.S. Labor Department data published on Sept. 13, 2023.

“The idea that most of the industry was able to pass on price increases close to, or even above the rate of inflation, is great,” said SmartXpo CEO Phil Stone.

When asked to compare the increases with inflation, he said: “The comparison with inflation is always interesting, but it can be misleading. The big picture is that any healthy business and any healthy industry wants and really needs to see evidence that it can pass on the impact of inflation and even increase its prices ahead of that.”

In this exclusive interview with TSNN, we caught up with Stone to take a deeper dive into the data and what it means for show organizers and exhibitors.

Back story

SmartXpo crunched the numbers from 230 trade shows that provided sufficient data for analysis (with at least two show cycles since 2020).

SmartXpo helps trade show organizers find the optimal price point using its Profisy pricing engine. SmartXpo uses AI to generate a data-driven answer to the unique challenge event organizers face when setting booth space prices.

“Because of the nature of what we do, we don't tend to name our clients,” Stone said, although he did reveal they tend to be overwhelmingly for-profit organizers based in Northern Europe or North America.

Why it matters

“There's always the question about what should the price be for the next edition,” Stone said. “It's a critical driver of value. If you get it right, it can help generate additional profit. If you get it wrong, then you've got to deal with very unhappy customers.”

He continued, “It's damaging and embarrassing to have to step back from it. The worst possible outcome is if you really get the price wrong, then you might blow up your entire show and kill part of your business. So it's really delicate.”

Pricing trends

In most countries, it has been possible for show organizers to match inflation when it comes to booth space pricing. However, there have been notable exceptions, such as Turkey, where trade show organizers have not been able to absorb the more than 50% increases that would have been necessary.

“It is interesting to note that a significant minority of organizers continue to hold back price increases below 7%, often displaying empathy with hard-hit clients,” said Stone.

Key Takeaways From The Report

Matching inflation is not enough. The analysis suggests a healthy portfolio should see a range of outcomes, with some shows comfortably exceeding a 10% price increase, even if sub-inflationary increases are appropriate for weaker events. A uniform policy of 7% increases would damage some shows while leaking value in many others. Over time, simply matching inflation is rarely good enough to create long-term value, he said.

Smaller, incremental price rises are better than large, occasional ones. It is possible for shows lagging behind inflation to catch up, but Stone said he expects it to get harder each year when the gap widens. The Profisy pricing engine analysis shows that smaller incremental price rises are typically accepted more readily than large, occasional ones.

Predictors of pricing power. Industry vertical, event quality, macroeconomics and geography are often the strongest predictors of pricing power. Demand, sales momentum, retention rates and customer sentiment also have a meaningful impact.

NPS alone is not a helpful guide for pricing. There is no statistically significant correlation between net promoter score (NPS) and pricing power. “Show survey feedback is essential and can tell us many things,” said Stone. “But NPS alone is not a helpful guide for pricing. Analysis of retention rates alongside broader measures of customer experience, intention to return and value-for-money ratings can unlock exhibitor lifetime value data and support price modeling.”

Download a free copy of the report here.

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on Twitter, Facebook and LinkedIn!

Add new comment