CEIR’s 2022 Third Quarter Index Results Demonstrate a Strong Rebound of the U.S. B2B Exhibition Industry is Continuing

According to the Center for Exhibition Industry Research (CEIR), the U.S. B2B exhibition industry continues to rebound, demonstrated by a continued improvement in Q3 2022 from the previous 10 quarters. This welcome news was announced by CEIR officials on Dec. 14 during Expo! Expo! IAEE’s Annual Meeting and Exhibition, taking place Dec. 13-15 in Louisville, Ky.

The in-person event cancellation rate remains low, although it increased slightly from 2 percent in Q2 to 3.1 percent in Q3, demonstrating a substantial improvement from 97.8 percent in Q3 2020 and 20.6 percent in Q3 2021, according to CEIR’s research.

Figure 1: B2B Exhibition Industry Cancellation Rate, Percentage

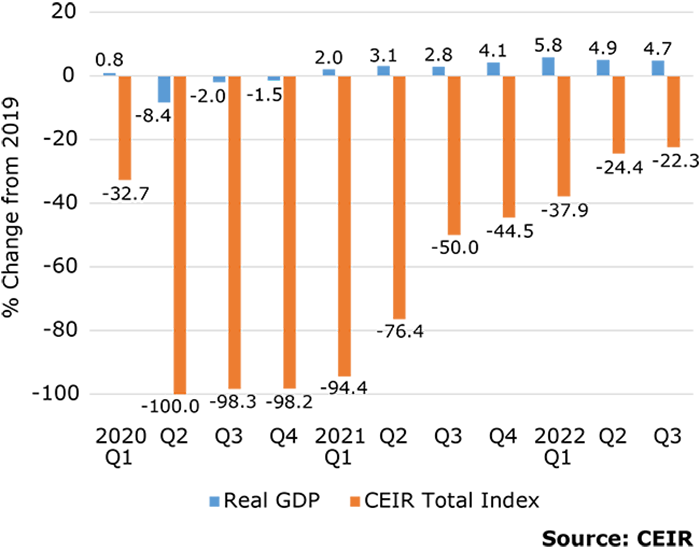

A relatively low cancellation rate and an improvement in completed events boosted the Q3 2022 Index result. As expected, the CEIR Total Index – a measure of overall exhibition performance – continues to recover, with a result 22.3 percent lower than 2019 (as shown in Figure 2). However, this marks a vast improvement compared to the past two years, including declines of 98.3 percent from 2019 in Q3 2020 and 50 percent from 2019 in Q3 2021.

U.S. GDP and the CEIR Total Index

The U.S. economy’s performance fared far better, registering a 4.7 percent increase in real (inflation-adjusted) GDP from Q3 2019 to Q3 2022. On a seasonally-adjusted annual rate (SAAR) basis, real GDP in Q3 increased 2.9 percent from the previous quarter, following two consecutive quarters of decline in Q1 and Q2.

This rebound primarily reflected an acceleration in nonresidential fixed investment, upturns in government spending at all levels, declines in imports that were partly offset by a smaller inventory accumulation, a larger decrease in residential fixed investment and a decline in consumer goods spending.

Up to Q4 2021, economic recovery had been led by strong spending on goods, however, the initially sluggish recovery in services industries has recently continued to pick up momentum. In Q3 2021, real spending on consumer services finally recovered pandemic losses and robust expansion has continued since that time. In Q3 2022, real spending on consumer services exceeded Q4 2019 spending levels by 3.3 percent.

Figure 2: Real GDP vs. CEIR Total Index, Q1 2020-Q3 2022, % Change from 2019

Q3 2022 Exhibition Industry Performance

Of all shows originally scheduled to be held in Q3 2022, 0.38% were postponed, 3.04 percent were canceled and 96.58 percent were completed as scheduled. Among canceled in-person events in Q3, approximately 38 percent pivoted to produce digital events. Excluding postponed events, the cancellation rate reached 3.1 percent, as indicated previously.

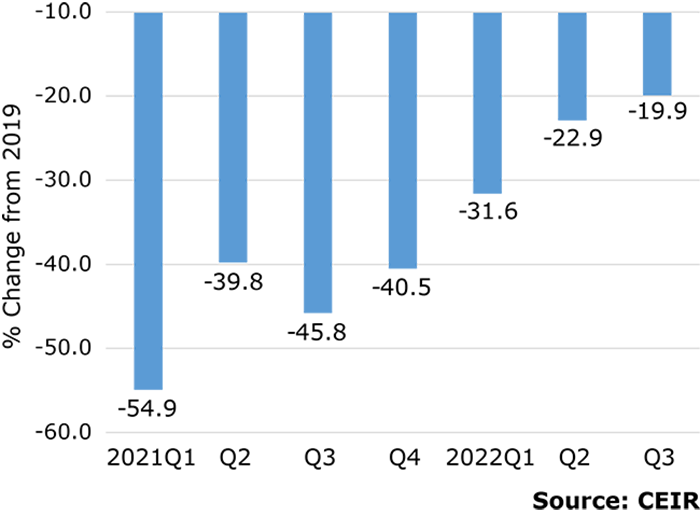

Figure 3 provides insights about events completed during Q1 2021 to Q3 2022, comparing performance of each to the same quarter in 2019.

While the Q3 2022 results reflect that a continuing but choppy and uneven recovery is underway, the direction is positive, with the overall Index and specific metrics improving for the past six quarters.

Among completed events, 14% have surpassed their pre-pandemic levels of the CEIR Total Index. Some show organizers launched new shows, expanded existing shows to new locations or held them at a different time of the year.

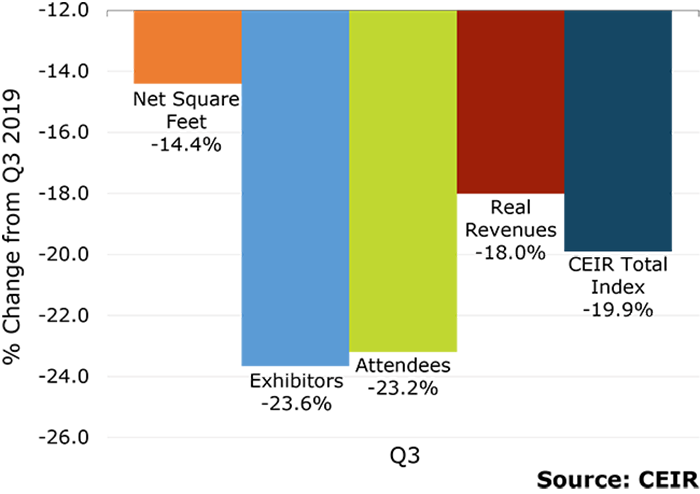

Looking at results excluding cancellations, the performance of events that happened in Q3 2022 demonstrates continued improvement, down only 19.9% compared to 2019 (Figure 3) – much better than the 54.9 percent decline registered in Q1 2021 compared to 2019.

Among four metrics, exhibitors suffered the largest decline of 23.6 percent, followed by attendees with a drop of 23.2 percent. Real revenues tumbled 18 percent, while net square feet (NSF) in Q3 was the metric that contracted the least at 14.4 percent from Q2 2019.

Figure 4: Q3 2022 CEIR Metrics for the Overall Exhibition Industry Excluding Cancellations, Percentage Change from Q3 2019

Insights on a Recession

Widespread views abound on whether the economy is in a recession or heading into one, and the outlook has implications for the exhibition industry. According to CEIR officials, a rebound in Q3 GDP and robust payroll employment gains throughout the year, including increases in October and November of 284,000 and 263,000 jobs respectively, dispel notions that the U.S. economy has been in a recession up to this point in 2022.

However, they added, persistent elevated inflation has created economic headwinds, prompting the Federal Reserve to take on aggressive interest rate hikes. At its Aug. 26th meeting, Federal Reserve Chairman Jerome Powell noted that the Federal Reserve remained committed to restoring price stability and bringing inflation in check. At the Nov. 3 meeting, Powell reaffirmed the Federal Reserve’s restrictive monetary policy stance.

While the pace of interest rate increases may slow from the Dec. 2022 meeting onward, the level of interest rates will remain high in 2023, resulting in a cooling of the economy. The probability is about 50-50 that the economy will slide into a recession during 2023, according to CEIR officials.

B2B Exhibitions Recovery

As the economy slows down further and businesses are more cautious, 2023 could prove to be a challenging year for the exhibitions industry, CEIR officials said.

“[Nonetheless], the B2B exhibition cancellation rate should remain extremely low, and the performance of completed events will continue to improve,” said CEIR Economist Dr. Allen Shaw, chief economist for Global Economic Consulting Associates, Inc. “A full recovery for the industry is expected in 2024.”

Among 14 industry sectors that CEIR monitors, the government and discretionary consumer goods and services sectors are expected to perform better, while the IT and building and construction sectors will lag behind the overall exhibition industry.

“Despite Omicron at the outset of 2022, CEIR research has documented an intent to return to face-to-face engagement at B2B exhibitions, and CEIR Index quarterly results show recovery is happening,” said CEIR CEO Cathy Breden. “Each quarter, the Index is showing that more business professionals and exhibitors are coming back to the B2B exhibitions channel to meet their marketing, sales and business information needs.”

Explanation and Definitions of Q3 Comparisons

As previously mentioned, 20.6 percent of trade shows scheduled to be held in the third quarter of 2021 were canceled, limiting the usefulness of comparisons of Q3 2021 and Q3 2022 results, as any positive change would be large and misleading. A more useful comparison is to the 2019 performance results, measured as the industry benchmark before COVID-19 forced the industry shutdown. Thus, events in the third quarter of 2022 are compared with those in the third quarter of 2019 (in Figures 2-4).

The CEIR Total Index in Figure 2 is a weighted average that includes both canceled events, with zero values for all exhibition metrics and completed events, while the Total Index in Figure 3 and Figure 4 exclude canceled events.

On May 24, CEIR released the 2022 CEIR Index Report, which analyzes the 2021 exhibition industry performance and provides an economic and exhibition industry outlook for the next three years. For more information and to access the complete 2022 CEIR Index Report as well as individual sector reports, go here.

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on Twitter, Facebook, LinkedIn and Instagram!

Add new comment