Informa to Buy Penton for $1.56 Billion

U.K.-based Informa is set to acquire U.S.-based Penton in a deal worth $1.56 billion from private equity owners MidOcean Partners and Wasserstein & Co.

The transaction is subject to approval by Informa shareholders and customary regulatory and closing conditions and is expected to close in the fourth quarter of 2016.

"Today, we are announcing continued progress on our Growth Acceleration Plan with the proposed addition of Penton Information Services,” said Stephen A. Carter, Informa Group CEO. “This combination will further strengthen our capabilities in Global Exhibitions and Business Intelligence and extend our US presence.”

He added, "The opportunity created through the combination of Informa and Penton balances our portfolio and increases our scale and reach, further improving the predictability and sustainability of our growth performance and cash generation."

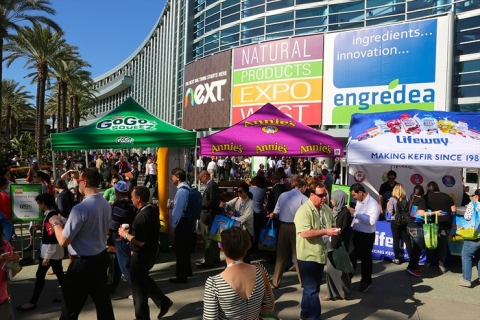

Some of Penton’s shows include Natural Products Expos West and East, WasteExpo and the massive farm shows - Farm Progress and Husker Harvest Days.

With the acquisition of Penton, Informa’s trade show portfolio will be one of the three largest in the U.S., with more than 70 U.S .exhibitions annually, including a total of 16 that were on TSNN’s Top 250 trade show list.

This continues its rapid growth during the last six years from a business reporting revenues of less than $100 million in 2009 to one delivering pro-forma revenue of more than $500 million.

Upon completion, the enlarged Informa Group will have a significant presence across the US, accounting for 47 percent of annual pro-forma revenues, according to company officials.

Barrett Gilmer, managing director of MidOcean Partners, and Anup Bagaria, co-managing Partner of Wasserstein & Co said: "Following extensive and exclusive discussions with Informa, we are delighted this transaction will take Penton to its natural next stage, combining two strong portfolios of exhibitions, data and information services businesses that will derive significant benefits from greater scale and international reach. We look forward to seeing these benefits materialize as ongoing shareholders in the enlarged Informa Group.”

Besides the trade shows, Penton also has a robust suite of digital brands in verticals including Infrastructure (Equipment Watch), Transportation (Aviation Week Intelligence Network) and Design & Manufacturing (SourceESB).

In addition, Penton also has Event Services, multi-channel B2B Media Brands, Digital Communities, B2B Content Marketing and other B2B Marketing Solutions.

“MidOcean and Wasserstein are seasoned, hands-on investors and have been invaluable partners in supporting Penton and allowing us to execute on our strategy,” said David Kieselstein, CEO of Penton. “Their strategic insight, resources, flexibility and experience in the media services sector have been essential to our transformation by enabling our organic growth through new investment initiatives and sourcing and coordinating multiple accretive acquisitions.”

Penton is just the latest in a string of acquisitions that Informa has made in the U.S. market, with the buy of Hanley Wood Exhibitions in 2014 and, more recently, the Light Reading portfolio.

Add new comment