TSNN Analysis: 8 Top Trends For U.S. Exhibition Industry Culled From New UFI Data

What’s the outlook for the U.S. and global exhibition industries? UFI, The Global Association of the Exhibition Industry, has released the 34th edition of its flagship Global Exhibition Barometer report, which takes the pulse of the industry.

Zooming out: For the global exhibition industry, revenues in 2024 and 2025 are expected to grow by a respective 16% and 18% year on year. Globally, 46% of companies declare they plan to increase their workforce in the coming six months, while another 51% declare that they will keep current staff numbers stable.

Context: “UFI’s Barometer research has provided like-for-like benchmarking on key metrics for 18 years, and this new edition shows positive indicators for the year ahead across all markets, which is heartening to see. However, at the same time, it shows some uncertainty around economic environments and geopolitical challenges, demonstrating we operate in an ever-changing world,” explained Chris Skeith, managing director and CEO at UFI.

Methodology: The latest edition of UFI’s bi-annual industry report was concluded in January 2025 and includes data from 390 companies in 56 countries and regions. The study also includes outlooks and analysis for 19 focus countries and regions – Argentina, Australia, Brazil, China, Colombia, France, Germany, Greece, India, Italy, Malaysia, Mexico, Saudi Arabia, South Africa, Spain, Thailand, the UAE, the UK, and the U.S., as well as five additional aggregated regional zones.

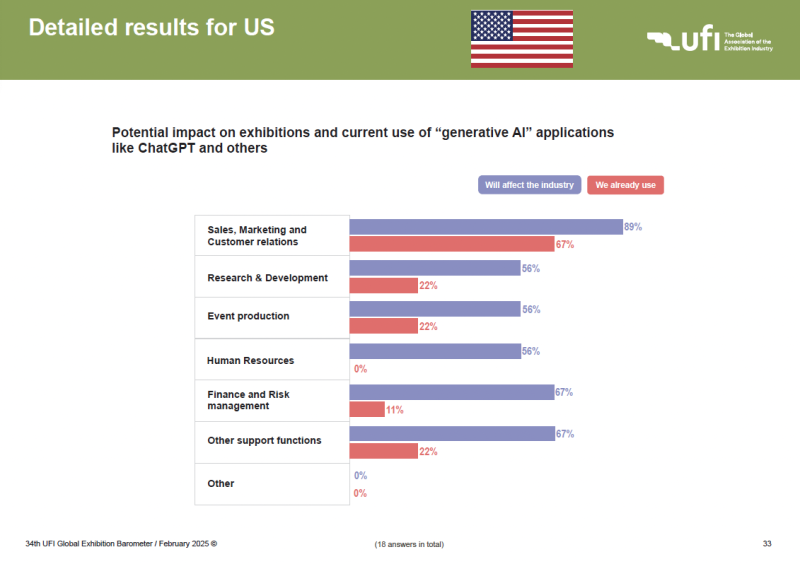

Deeper dive: There is a clear consensus that the industry is using AI, with 92% of companies stating this, according to the barometer. For the first time since this question was introduced a year ago, a majority of businesses report they’re already using this technology in “Sales, Marketing and Customer relations” functions, showing an unprecedented speed of adoption.

What they’re saying: “Many of the results validate the various projects UFI is working on in our centenary year, seeking greater recognition for the industry from policymakers, supporting our members to attract and retain the very best talent and help in the continued focus on sustainability and climate as all feature highly in the report,” Skeith said.

TSNN Analysis: Top 8 Trends for U.S. Exhibition Industry

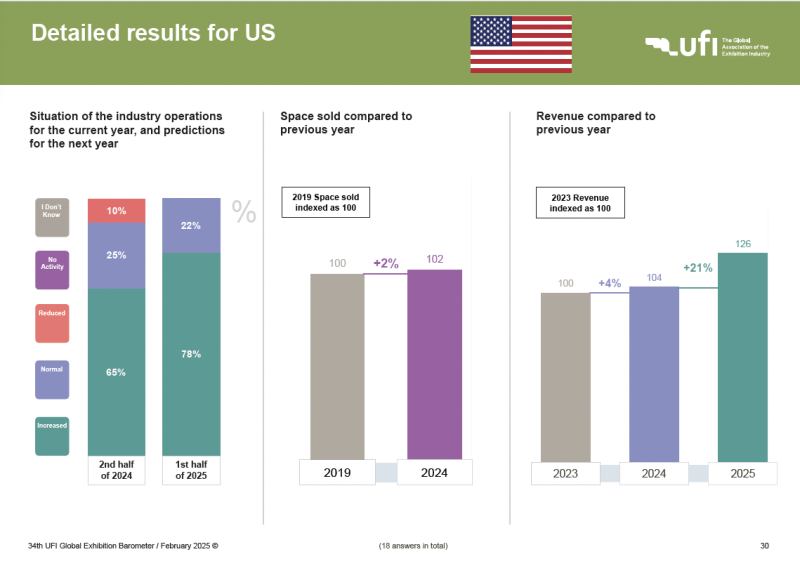

1. Positive outlook in U.S. In the 2nd half of 2024, 65% of respondents indicated they increased industry operations and only 10% reported a decline. For the first half of 2025, 78% of respondents are predicting an increase in industry operations and none are reporting a reduction.

2. Exhibition space surpasses pre-COVID levels in U.S. Compared with 2019, respondents reported a 2% increase in exhibit space sold in 2024.

3. Double-digit revenue growth projected for 2025 in U.S. Compared with 2023, 2024 revenues increased 4%. In 2025, respondents are projecting a 21% increase year over year.

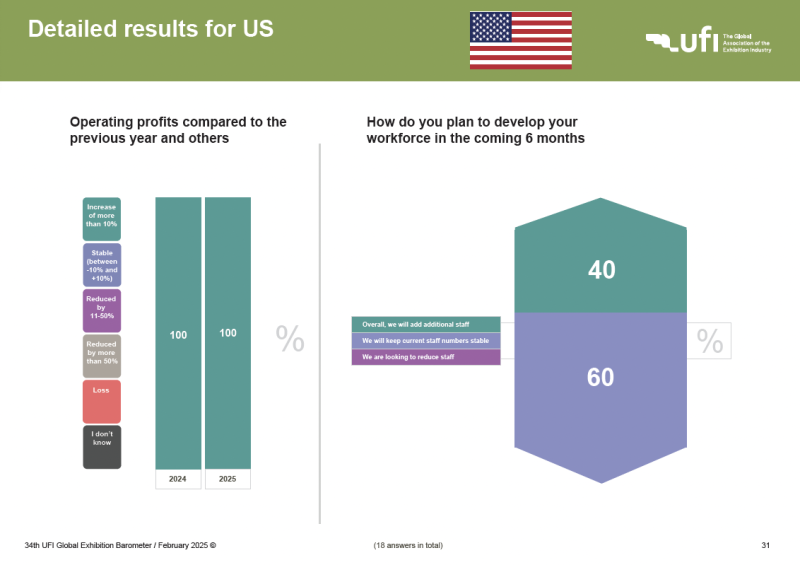

4. Operating profits expected to rise by double digits. Compared to the previous year, all respondents reported an increase in operating profits of more than 10% in 2024 and are predicting the same increase in 2025.

5. No staff reductions ahead in U.S. Overall, 40% of U.S. respondents will add staff in the next six months of 2025. No respondents report they will be reducing staff in the next six months.

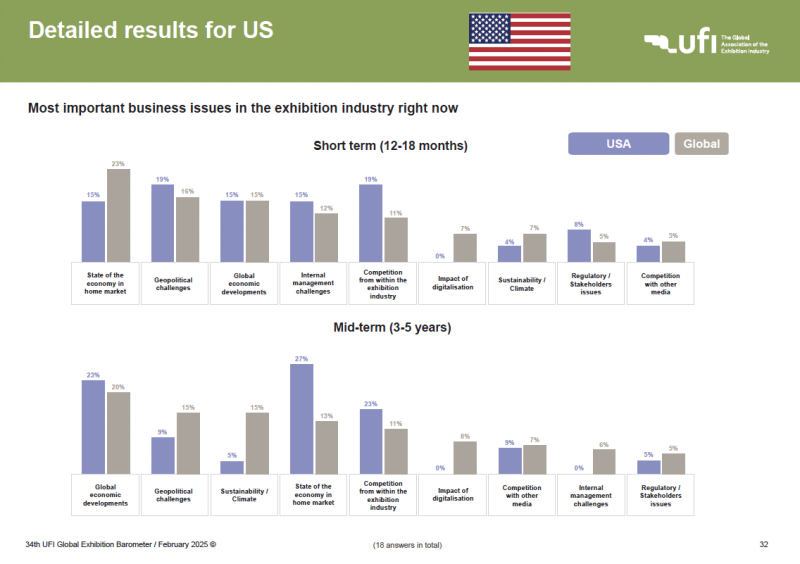

6. Top issue facing the U.S. exhibition industry in the short term. Geopolitical challenges and competition from within the exhibition industry, with 19% of respondents citing these two business issues as the most important facing the exhibition industry in the next 12-18 months.

7. Top issue facing the U.S. exhibition industry in the mid term. State of the economy in home market. In fact, 27% of respondents cited the state of the economy in home markets as the No. 1 business issue facing the exhibition industry in the next 3-5 years, compared with 12% of global respondents. The top issue for global respondents: 20% cited global economic developments.

8. Majority of organizers are using generative AI for sales. When asked about the potential impact on exhibitions and current use of generative AI, like ChatGPT and others, 67% of U.S. respondents report they are already using AI for sales, marketing, and customer relations. Only 22% of U.S. respondents report they are currently using AI for event production and research and development.

What’s next

The full results can be downloaded at www.ufi.org/research. The next UFI Global Exhibition Barometer survey will be conducted in June 2025.

Add new comment